|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

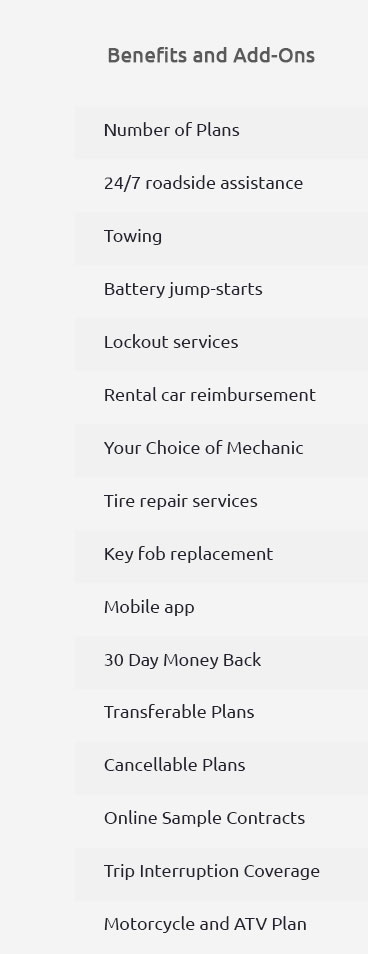

Car Breakdown Insurance: Coverage GuideCar breakdown insurance is an essential consideration for U.S. consumers looking to protect their vehicles and wallets from unexpected repair costs. This type of insurance offers peace of mind by covering the costs of mechanical failures and roadside assistance. Whether you're commuting in Los Angeles or exploring the scenic routes of New York, having car breakdown insurance ensures you're never stranded. Understanding Car Breakdown InsuranceCar breakdown insurance, often intertwined with extended auto warranties, covers a wide range of potential vehicle issues. From engine failures to electrical problems, this insurance saves you from hefty repair bills. What's Covered?Typically, this insurance covers:

By having this coverage, you can avoid the stress of unexpected expenses and enjoy your drive, whether it's a quick trip to the grocery store or a long-distance journey. Benefits of Car Breakdown InsuranceInvesting in car breakdown insurance is a smart move. Here’s why:

For example, if your car breaks down on a busy New York highway, your insurance can cover the towing and repair costs, allowing you to focus on your daily activities. Exploring Extended Auto WarrantiesExtended auto warranties are often offered by manufacturers and third-party providers to enhance your vehicle's protection. These warranties extend the coverage period beyond the standard manufacturer warranty. For instance, if you're a Honda owner, exploring honda warranty customer service can provide valuable insights into the specific coverages and options available for your vehicle. Choosing the Right PlanWhen selecting an extended warranty or breakdown insurance plan, consider:

These factors will help you find the right plan that offers superior protection car warranty tailored to your needs. FAQsWhat is car breakdown insurance?Car breakdown insurance is a policy that covers the cost of vehicle repairs and roadside assistance in the event of a mechanical failure. How does car breakdown insurance differ from an extended warranty?While both provide protection against repair costs, car breakdown insurance often covers a wider range of services, including roadside assistance, whereas extended warranties typically extend the original manufacturer's warranty. Is car breakdown insurance worth it?Yes, especially for those who drive older vehicles or frequently travel long distances. It offers peace of mind and potential cost savings on unexpected repairs. Car breakdown insurance is an invaluable resource for U.S. drivers. By ensuring your vehicle is covered, you can drive with confidence, knowing that help is just a phone call away, no matter where you are. https://www.libertymutual.com/insurance-resources/auto/does-car-insurance-cover-routine-maintenance

What's Mechanical Breakdown Coverage? Mechanical breakdown insurance is an optional coverage available from some insurance companies. This type of coverage ... https://www.gocompare.com/breakdown-cover/

Breakdown cover helps you get back on the road if you can't get your vehicle up and running. It's typically not included in your motor ... https://www.thezebra.com/auto-insurance/coverage/mechanical-breakdown-insurance/

Mechanical breakdown insurance (MBI) is one option, along with collision and comprehensive coverage, which cover damage from accidents and external events.

|